The smart Trick of Insurance Quotes That Nobody is Discussing

Wiki Article

Insurance Advisor - Truths

Table of ContentsAn Unbiased View of Insurance CodeThe Only Guide for Insurance Agent Job DescriptionAbout Insurance ExpenseThe Of Insurance Asia AwardsSome Known Facts About Insurance Code.How Insurance And Investment can Save You Time, Stress, and Money.

Disability insurance can cover long-term, temporary, partial, or complete impairment. Nonetheless, it does not cover healthcare as well as services for long-lasting treatment. Do you require it? The Facility for Disease Control and also Avoidance states that almost one in four Americans have a special needs that impacts significant life events, which makes this type of insurance sensible for everybody, also if you're young and also single.

Life Insurance Policy for Kids: Life insurance policy exists to replace lost revenue. Kids have no income. Accidental Death Insurance Policy: Even the accident-prone needs to avoid this kind of insurance policy. It usually has so several constraints, that it's virtually impossible to collect (insurance ads). Disease Insurance coverage: A healthiness insurance policy is possibly a far much better investment than trying to cover on your own for each sort of ailment that's around.

These are the most essential insurance coverage types that offer substantial economic alleviation for really sensible situations. Outside of the 5 main kinds of insurance coverage, you ought to assume meticulously prior to purchasing any added insurance policy.

Insurance Code - An Overview

Remember, insurance is suggested to safeguard you as well as your financial resources, not injure them. If you require aid with budgeting, attempt using a expense settlement tracker which can help you maintain all of your insurance payments so you'll have a much better hold on your personal financial resources. Associated From budget plans as well as expenses to complimentary credit history score as well as even more, you'lldiscover the effortless method to remain on top of everything.There are countless insurance coverage options, as well as many economic professionals will certainly claim you require to have them all. It can be difficult to establish what insurance you truly need.

Variables such as kids, age, way of life, and work advantages contribute when you're building your insurance coverage profile (insurance agent). There are, nonetheless, four types of insurance coverage that the majority of monetary professionals recommend all of us have: life, health and wellness, automobile, and also long-term impairment. 4 Sorts Of Insurance Policy Everyone Requirements Life insurance policy The best benefits of life insurance coverage consist of the ability to cover your funeral expenditures and also attend to those you leave.

The smart Trick of Insurance Advisor That Nobody is Discussing

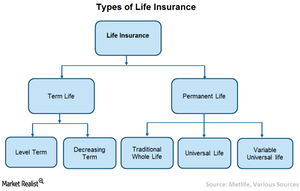

Both basic kinds of life insurance policy are standard entire life as well as term life. Merely described, whole life can be utilized as a revenue tool along with an insurance policy tool. As long as you remain to pay the month-to-month premiums, whole life covers you till you die. Term life, on the other hand, is a plan that covers you for a set quantity of time.

Often, even those workers who have excellent wellness insurance policy, a wonderful savings, and also a good life insurance coverage plan don't plan for the day when they might not have the ability to function for weeks, months, or ever before again. index While wellness insurance policy pays for a hospital stay and medical bills, you're still entrusted to those everyday expenses that your income usually covers.

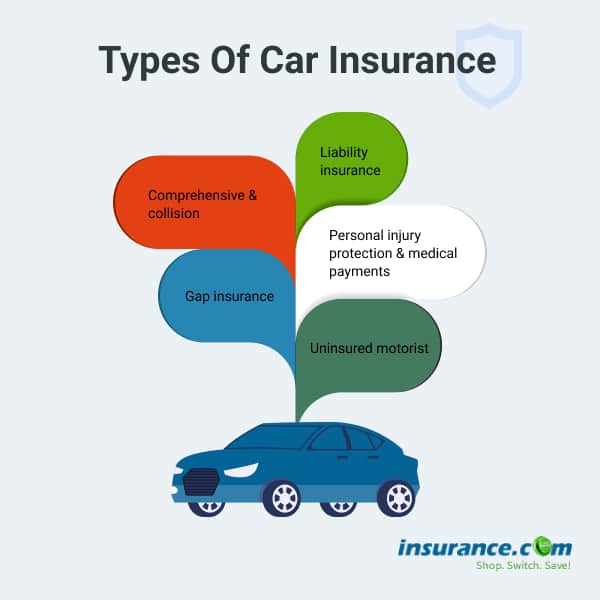

Rumored Buzz on Insurance

Numerous employers use both brief- and also long-term handicap insurance as component of their benefits plan. This would certainly be the most effective choice for securing economical impairment insurance coverage. If your employer does not offer long-term insurance coverage, here are some points to take into consideration prior to acquiring insurance coverage on your own. A plan that ensures revenue substitute is ideal.7 million auto mishaps in the U.S. in 2018, according to the National Freeway Web Traffic Safety Management. An estimated 38,800 individuals died in auto accidents in 2019 alone. The top reason of fatality for Americans between the ages of 5 and also 24 was automobile mishaps, according to 2018 CDC information.

7 million vehicle drivers as well as passengers were injured in 2018. The 2010 financial prices of vehicle crashes, including deaths and also disabling injuries, were around $242 billion. While not all states call for chauffeurs to have vehicle insurance, the majority of do have regulations relating to monetary duty in the event of a mishap. States that do call for insurance policy conduct routine random checks of motorists for proof of insurance.

Some Known Questions About Insurance Expense.

If you drive without automobile insurance coverage as well as have an accident, penalties will probably be the least of your economic burden. If you, a passenger, or the other chauffeur is harmed in the mishap, car insurance policy will cover the expenditures as well as help safeguard you versus any type of lawsuits that might arise from the accident.Once again, just like all insurance, your private circumstances will determine the expense of auto insurance coverage. To ensure you get the ideal insurance for you, compare numerous price quotes and also the coverage supplied, and examine regularly to see if you get approved for reduced rates based upon your age, driving document, or the location where you live (insurance expense).

Constantly get in touch with your company initially for readily available coverage. If your employer doesn't provide the kind of insurance you want, acquire quotes from numerous insurance suppliers. Those who provide insurance coverage in numerous insurance gcash areas might give some discounts if you purchase more than one kind of coverage. While insurance coverage is costly, not having insurance benefits it might be much much more expensive.

Not known Facts About Insurance Companies

Insurance is like a life jacket. It's a bit of a hassle when you do not require it, but when you do need it, you're greater than thankful to have it. Without it, you can be one cars and truck wreckage, health problem or home fire far from drowningnot in the sea, however in the red.Report this wiki page